It has barely been a year since the sad demise of Ratan Tata, and already storm clouds are gathering over the Tata Group. The board members are in such a tug-of-war that the government had to step in. On October 7, trustees of the Tata Trust met with Finance Minister Nirmala Sitharaman and Home Minister Amit Shah in Delhi, seeking intervention.

But what exactly is happening at Tata Group? Is this issue related to Tata Sons or Tata Trust? What is the difference between Tata Sons and Tata Trust? Who is the real owner of Tata Group? What caused this dispute? And how will it affect the other companies in the Tata Group? Is there anyone capable of running the group after Ratan Tata? Why is the RBI pushing Tata Sons to go for an IPO, and why is Tata Sons resisting? Why does Shapoorji Pallonji Group, the second-largest trustee of Tata Sons, want to exit by selling its shares? Let’s break it all down.

Table of Contents

Understanding Tata Group’s Real Ownership

Before diving into the disputes, let’s clarify who really owns Tata Group. Two key entities are involved: Tata Sons (TS) and Tata Trust.

Tata Sons: The Parent Company

Whenever we talk about Tata Group—a conglomerate with a market cap exceeding ₹30 lakh crore, more than a million employees, and a brand value higher than Pakistan’s GDP—we are essentially talking about Tata Sons. Tata Sons is the parent company that oversees all other companies, including TCS, Tata Motors, Tata Steel, Titan, Tata Consumer Products, Air India, Tata Chemicals, and even ventures in defense and semiconductors.

Tata Sons has over 400 companies under its control, out of which 29 are already listed, and Tata Capital is about to be the 30th.

The role of Tata Sons is strategic:

- Supporting existing companies and channeling their profits.

- Covering losses of companies when needed.

- Financing new ventures.

- Making major decisions on the group’s future, such as entering new sectors like defense, semiconductors, or EVs.

In short, Tata Sons manages strategic growth, investments, and overall profit allocation across the group. Despite being the group’s central authority, Tata Sons itself is privately held.

Wings Robin 2025 JUST LIKE TATA NANO EV

Tata Trust: The Owner of Tata Sons

Here’s where the complexity begins. Tata Sons is owned by Tata Trust, which holds 66% of TS shares. Normally, a trust doesn’t own a company, but Tata Group was designed to generate wealth for society. The trust ensures that the group’s profits are primarily used for philanthropy and social good rather than personal gains.

Other shareholders include:

- Shapoorji Pallonji Group (18%)

- Various Tata Group companies (13%)

- Individual shareholders (2.85%)

Ratan Tata had only a minimal stake but commanded immense influence because of his reputation, vision, and integrity.

The Current Dispute

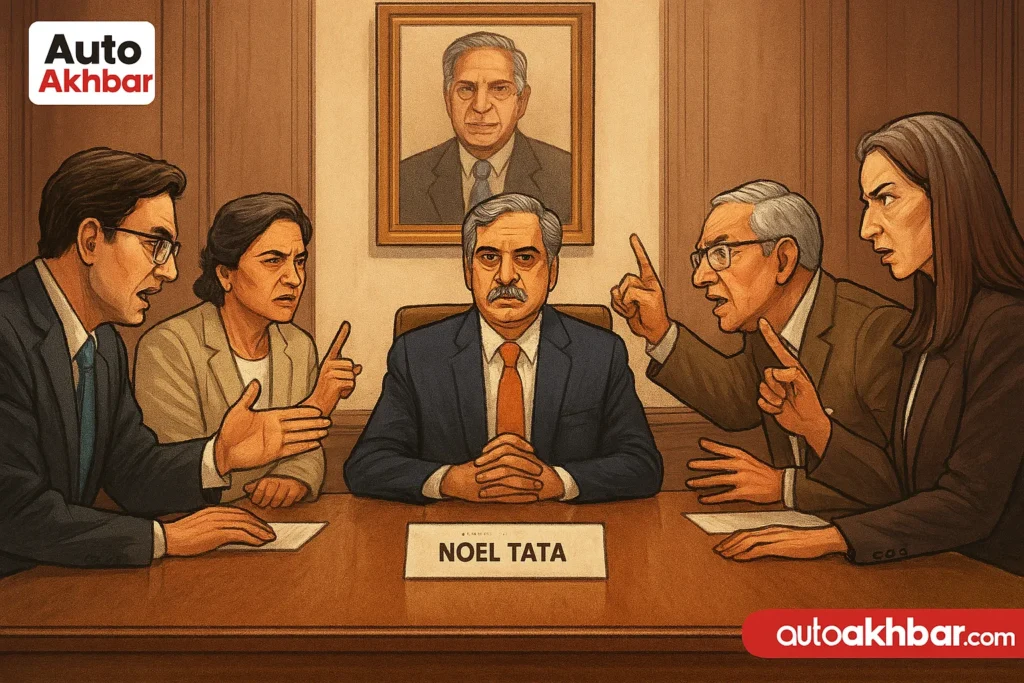

After Ratan Tata, Noel Tata took over as chairman of Tata Trust. While N. Chandrasekaran continues to lead Tata Sons effectively, the dispute has arisen within the trust itself.

Seven trustees were involved, including:

- Noel Tata (Chairman)

- Venu Srinivasan (TVS Group)

- Vijay Singh (ex-Defense Secretary)

- Mallya Mistry (close friend of Ratan Tata)

- Pramit Jhaveri (ex-Citi Bank)

- Jahangir C (Jahangir Hospital)

- Darius Khambata (senior advocate)

After Ratan Tata’s passing, new rules came into place for trustees above 75 years, requiring annual reappointment via voting. When Vijay Singh, aged 77, was up for reappointment, Noel Tata and Venu Srinivasan approved, but four trustees opposed, resulting in Vijay Singh resigning.

This created a deadlock where trustees like Mallya Mistry are trying to assert influence, while Noel Tata aims to maintain control.

Secondary and Tertiary Disputes

Shapoorji Pallonji Group Conflict

The SP Group, holding 18% of Tata Sons, wants flexibility to sell or pledge their shares due to financial pressures. However, Tata Trust refuses, citing founding agreements and long-term stability, prioritizing social responsibility over profit-driven motives.

RBI Pressure on IPO

RBI considers Tata Sons a major NBFC due to intra-group lending and recommended a public listing within three years. Tata Sons resists, arguing that going public would compromise their philanthropic model, as quarterly disclosures would interfere with strategic decision-making and long-term investments. Currently, Tata Sons is debt-free and compliant, and the RBI has not enforced the IPO yet.

Ola Shakti Launch: ₹29,999 Smart Battery

Implications for Tata Group and Stock Market

The operational companies like TCS and Tata Motors are unaffected for now. But the deadlock at the top affects:

- Decisions on entering new sectors

- Allocation of loans and investments

- Strategic growth initiatives

If disputes continue, internal factions may form within Tata Sons, potentially affecting productivity, efficiency, and market perception, which could ripple into India’s stock market and economy.

Conclusion

The Tata Group crisis highlights the challenge of succession and governance after iconic leaders like Ratan Tata. With multiple disputes involving Tata Trust, SP Group, and RBI, the future direction of the group faces uncertainty. While day-to-day operations remain stable, strategic growth and new sector entries might face hurdles until the disputes are resolved.

From all of us who admire Ratan Tata and the Tata legacy, we hope for a swift resolution and continued prosperity for India’s most valuable conglomerate.

FAQ Tata Group Crisis Explained

What is the Tata Dispute?

The Tata dispute primarily refers to the ongoing internal conflicts within Tata Trust and its relation to Tata Sons, which escalated after the passing of Ratan Tata. The deadlock among trustees, disagreements over appointments, and shareholder conflicts with the Shapoorji Pallonji Group are central to this dispute.

What is the Tata Trust Dispute?

The Tata Trust dispute is the conflict among trustees regarding control and decision-making authority. After Ratan Tata’s passing, Noel Tata became chairman of Tata Trust. Trustees like Mallya Mistry and others are asserting influence, while Noel Tata is trying to maintain strategic control. This has caused a deadlock affecting major Tata Sons decisions.

Who Owns Tata Group?

The Tata Group is owned and controlled by Tata Sons, which in turn is majority-owned by Tata Trust (66% shares). Other shareholders include Shapoorji Pallonji Group (18%), various Tata companies (13%), and individuals (2.85%). The real strategic decisions are handled by Tata Sons.

What is the Future of Tata Group After Ratan Tata?

After Ratan Tata, the future of Tata Group depends on how the current Tata Trust dispute resolves. N. Chandrasekaran continues to lead Tata Sons effectively, but trustee conflicts could delay strategic decisions. The group’s expansion into sectors like EVs, semiconductors, and defense may face hurdles.

Who Could Be the Next Owner of Tata Group?

Technically, the next owner of Tata Group remains Tata Trust, with Noel Tata as its chairman. Strategic control lies with Tata Sons, led by N. Chandrasekaran. Shareholding by Shapoorji Pallonji Group and other individuals ensures multiple stakeholders, making it unlikely for a single “next owner” outside the trust structure.

Role of Former Tata Group Chairman Cyrus Mistry

Cyrus Mistry was appointed chairman of Tata Sons in 2012 but was removed in 2016 due to strategic disagreements. His case became a landmark for corporate governance and is often referred to as Cyrus Mistry and Tata Sons case study.

How Did JRD Tata and Ratan Tata Build the Group?

JRD Tata founded and expanded the Tata Group over decades, establishing companies across multiple sectors—Tata Steel, TCS, Tata Motors, Titan, Air India, and more—through strategic reinvestment of profits and philanthropy-focused business practices. Ratan Tata continued this legacy, doubling revenues and tripling profits during his tenure.

How Tata Trust Was Set Up and Works

Tata Trust was set up to ensure that profits from Tata Sons are used for social good and philanthropy, rather than personal gains. Tata Trust owns 66% of Tata Sons, overseeing strategic and philanthropic decisions. It also enforces shareholder agreements, ensuring stability and preventing profit-driven interference.

RBI Action on Tata Sons

RBI considers Tata Sons a significant NBFC due to intra-group lending. RBI recommended that Tata Sons go for an IPO within three years. However, Tata Sons resisted, citing its non-profit-oriented, philanthropic mindset and the need for private decision-making. Currently, Tata Sons is debt-free and compliant, with RBI not enforcing the IPO.

Tata Sons Company Structure

Tata Sons is the parent company of the Tata Group, overseeing 400+ companies, including 29 listed entities. Its role is strategic management, investment, and profit allocation for group-wide growth. Tata Sons is privately held, majority-owned by Tata Trust, with other stakeholders including Shapoorji Pallonji Group and individual shareholders.