Germany has always been a big supporter of electric cars, making them cheaper and more appealing for buyers.

But after some recent policy changes and budget cuts, many people are now wondering:

- Is the subsidy still there in 2025?

- How much money can I get?

- Do leased cars also qualify?

- Are plug-in hybrids still included?

We’ve done the digging so you don’t have to—here’s a simple guide to Germany’s Electric Car Subsidy (Umweltbonus) in 2025.

+

Table of Contents

What is the Germany EV Subsidy (Umweltbonus)?

The Umweltbonus—also known as the Environmental Bonus—is a government grant that helps people buy new electric and hydrogen-powered cars.

It started to:

- Bring down the price of EVs

- Help move away from petrol and diesel cars

Even though funding was cut at the end of 2023, the subsidy is still available in 2025, but only until December 31, 2025.

Who Can Apply?

You can get the subsidy if you are:

- A private person

- A company

- A foundation or association

Conditions:

- The car must be registered in Germany.

- You must keep the car for at least six months before selling or transferring it.

Which Cars Qualify?

1. Battery Electric Vehicles (BEVs) & Hydrogen Fuel Cell Vehicles (FCEVs)

- Price before tax: Up to €65,000

2. Plug-in Hybrid Electric Vehicles (PHEVs)

- CO₂ emissions: 50 g/km or less

- Electric range: At least 40 km

- Price before tax: Up to €65,000

💡 Used cars don’t qualify—only brand-new, never-registered vehicles are eligible.

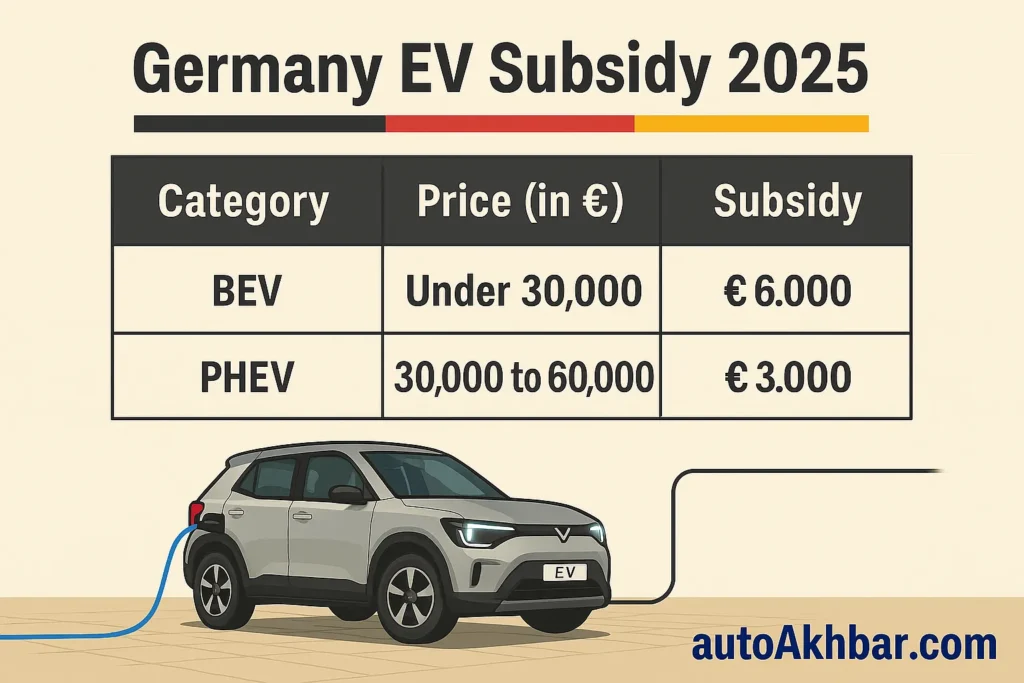

How Much Can You Get in 2025?

| Vehicle Type | Price Before Tax (< €40,000) | Price Before Tax (€40,000 – €65,000) |

|---|---|---|

| BEV / FCEV | €6,000 | €5,000 |

| PHEV | €4,500 | €3,750 |

How to Apply – Step by Step

- Buy or lease an eligible EV before December 31, 2025.

- Register it in Germany under your name (or your company’s name).

- Apply online at BAFA (Federal Office for Economic Affairs and Export Control).

- Submit:

- Proof of purchase or lease

- Vehicle registration papers

- A declaration saying you’ll keep the car for six months

Special Rules for Leased Cars

Yes—leased cars can get the subsidy.

But you must be the official registered owner during the required six-month period. If the leasing company owns the car, the benefit might be added to your lease price—or not passed on at all.

Why This Matters in 2025

In 2024, electric car sales in Germany dropped by 37% after subsidy cuts.

This year is one of the last chances to get thousands of euros off a new EV before the scheme ends.

If you buy a car under €40,000, you could still save €6,000, which might make going electric much more affordable.

Extra Tips Nobody Talks About

- 6-month rule: Sell early and you’ll have to pay the money back.

- Price cap warning: Adding expensive extras that push the price over €65,000 will make you lose the subsidy.

- Businesses win big: Companies can claim subsidies on multiple EVs if each meets the rules.

Bottom Line

If you’re planning to buy or lease a new electric car in Germany in 2025, the Umweltbonus is still worth claiming before it ends.

Make sure your car qualifies, follow the rules, and keep it for six months to enjoy the savings.

References

- BAFA – Federal Office for Economic Affairs and Export Control – Official Umweltbonus Guidelines

- German Federal Ministry for Economic Affairs and Climate Action – EV Policy Updates 2025

- VDA – German Association of the Automotive Industry – EV Market Data Germany

Frequently Asked Questions – Germany Electric Car Subsidy 2025

Is the Germany EV Subsidy still available in 2025?

Yes. The Umweltbonus is still available in 2025 but will end on December 31, 2025.

Who can apply for the subsidy?

Private individuals, companies, foundations, and associations can apply—provided the vehicle is registered in Germany and kept for at least six months.

Do leased cars qualify for the subsidy?

Yes, leased vehicles qualify, but you must be the registered owner during the required period. If the leasing company owns the vehicle, they might pass on the benefit indirectly.

Are used electric cars eligible for the subsidy?

No. Only brand-new, unregistered electric or hydrogen-powered vehicles are eligible.

Are plug-in hybrids (PHEVs) still eligible?

Yes, but only if they meet strict CO₂ emission (≤ 50 g/km) and electric range (≥ 40 km) requirements.

Can businesses claim multiple subsidies?

Yes. Businesses can claim subsidies for multiple vehicles, provided each meets the eligibility rules.

What happens if I sell my car before six months?

You’ll have to repay the subsidy if the ownership changes before the six-month lock-in period ends.

Does the subsidy cover optional extras?

Yes, but if the total price (including extras) goes above €65,000, your vehicle becomes ineligible.