In 2025, with rising inflation and increasing car insurance premiums, managing your auto expenses is more important than ever. Fortunately, there are several smart and actionable strategies to reduce your car insurance premium without compromising coverage.

Below are the top tips to help reduce car insurance premium SAVE A BIG SHOT!!

Table of Contents

✅ 1. Transfer Your No Claim Bonus (NCB)

No Claim Bonus (NCB) is a reward for not making any insurance claims during the policy year. It can reduce your premium by up to 50% over 5 claim-free years.

📝 Pro Tips:

- NCB is linked to you, not your car. If you buy a new car, transfer your NCB from the old policy.

- Ask your insurer for an NCB certificate when selling your old car.

- Avoid small claims. Instead, pay out-of-pocket for minor damages to maintain your NCB.

🔗 Learn more about NCB benefits here (IRDAI.gov.in)

✅ 2. Avoid Claims for Minor Damages

Think twice before filing claims for small repairs like cracked mirrors or scratched bumpers.

💡 Example:

A minor repair might cost ₹2,000–₹3,000. But claiming it can reset your NCB to zero, costing you thousands more in premium over time.

📌 Actionable Tip:

Skip insurance claims for minor expenses. Protect your long-term savings instead.

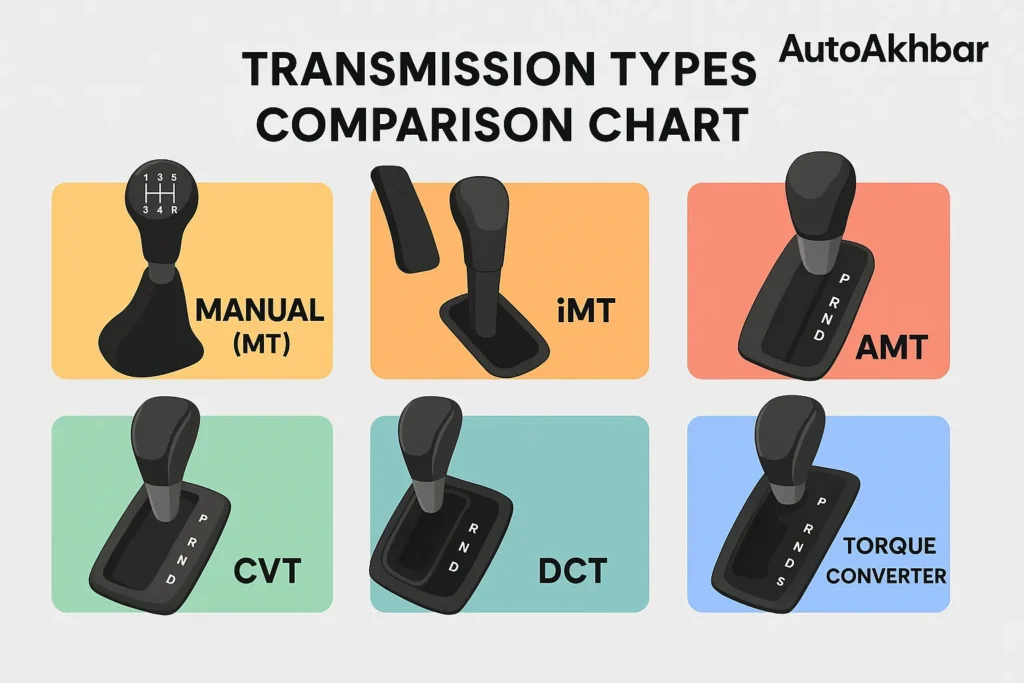

Types of Automatic Transmissions – Explained

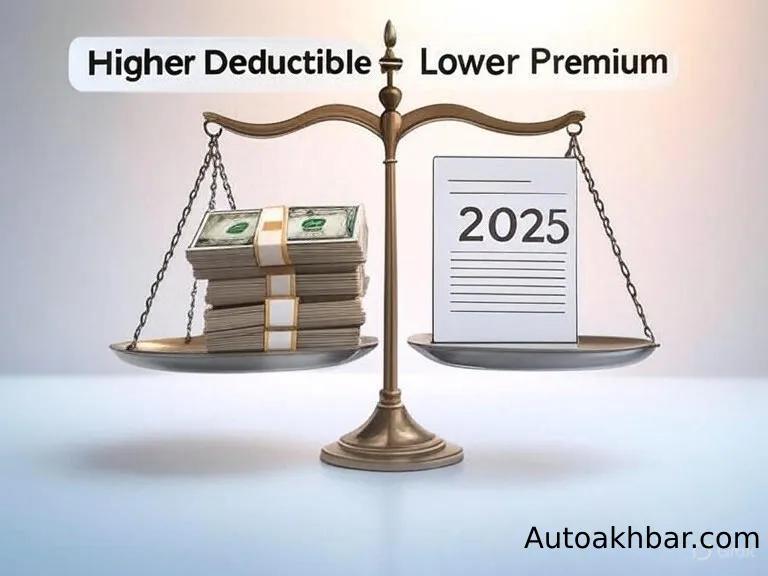

✅ 3. Opt for a Higher Deductible

A deductible is the amount you agree to pay before the insurer pays the rest. Choosing a higher voluntary deductible can significantly reduce your premium.

📊 For example:

- Deductible ₹5,000 → Lower premium

- Deductible ₹0 → Higher premium

⚠️ Caution:

Only choose a higher deductible if you’re financially comfortable handling that amount in case of a claim.

BYD Blade Battery Technology – Full Breakdown

✅ 4. Install ARAI-Certified Anti-Theft Devices

Installing security devices like:

- Car alarms

- GPS trackers

- Kill switches

- Steering/tire locks

… can make your vehicle safer and reduce insurance risk. This may get you up to 2.5% discount on your premium.

🔐 Must-Have:

Ensure your anti-theft device is ARAI-certified (Automotive Research Association of India) to qualify for discounts.

✅ 5. Buy Car Insurance Online

Purchasing insurance through digital platforms often gives better pricing due to lower operational costs.

💻 Benefits:

- Compare multiple policies easily

- Get instant premium quotes

- Avail special online discounts

🛒 Visit trusted platforms like PolicyBazaar, ACKO, or Turtlemint to explore online car insurance offers.

✅ 6. Be Selective with Add-On Covers

While add-ons like zero depreciation, engine protect, or return-to-invoice are useful, each increases your premium.

🍕 Think of it like ordering a pizza:

- The base (policy) is enough.

- Every extra topping (add-on) increases the cost.

🎯 Tip:

Choose add-ons based on:

- Your car’s age

- Local driving conditions

- Genuine risk

❌ Avoid unnecessary add-ons like tyre protection for old cars.

✅ 7. Limit Expensive Car Modifications

Flashy rims or premium audio systems might make your car stand out, but they increase the insured declared value (IDV) and raise your premium.

⚠️ Modifications increase risk (and theft probability) from the insurer’s viewpoint, resulting in:

- Higher premium

- Rejected claims (if modifications are undeclared)

💡 Stick to factory specs or declare any changes honestly.

📈 Bonus Tip: Renew on Time!

Letting your policy lapse means:

- NCB expires if not renewed within 90 days

- Policy may need inspection again

- Higher premium next time

📆 Set a reminder and renew before expiry to keep premiums low and uninterrupted coverage.

This article is brought to you by Auto Akhbar – your trusted car news portal.

FAQ ON Reduce Car Insurance Premium

How can I get the lowest car insurance rates?

To get the lowest car insurance rates, maintain a clean driving record, avoid unnecessary claims, and take advantage of your No Claim Bonus (NCB). Opting for a higher voluntary deductible, installing ARAI-certified anti-theft devices, and buying your policy through online platforms can further reduce your premium. Also, avoid expensive car modifications and be selective with optional add-ons to keep costs low.

How can I reduce my policy premium?

You can reduce your car insurance policy premium by:

- Transferring your existing NCB to your new policy

- Avoiding small claims to maintain your NCB

- Choosing a higher deductible responsibly

- Installing safety enhancements like anti-theft devices

- Skipping unnecessary add-ons like tyre protection or engine cover for older vehicles

- Comparing policies online before buying or renewing

Small steps like these can lead to significant long-term savings.

What are the best ways to save on car insurance?

The best ways to save on car insurance in 2025 include:

- Maintaining a no-claim history to maximize NCB discounts

- Buying or renewing insurance through online aggregators

- Installing certified safety and anti-theft devices

- Choosing only essential add-ons

- Limiting expensive car upgrades that raise premiums

- Renewing your policy on time to avoid NCB expiry

Planning your insurance smartly can help you balance cost and coverage effectively.